As global awareness of oral health continues to rise, the international trade of dental-related products has become increasingly frequent. To ensure the smooth import and export of these products, understanding and accurately applying the relevant Harmonized System (HS) codes is crucial. HS codes serve as a standardized classification system for goods in international trade, providing a foundation for customs regulation while also facilitating trade between countries.

Dental-related products, including but not limited to dentures, dental materials, dental equipment, and dental instruments, come in a wide variety with different applications. Therefore, when importing or exporting these products, it is essential to carefully verify and correctly declare their HS codes to avoid clearance delays, increased tariffs, or even legal disputes due to incorrect coding.

This article aims to provide an overview of HS codes for dental-related products, helping readers understand the classification principles and coding rules for these items. By following this guide, readers will be better equipped to accurately identify HS codes for dental products, ensuring smoother transactions in international trade.

HS Codes for Dental Products

HS (Harmonized System) codes are essential for the classification of goods in international trade, ensuring accurate customs declarations and tariff applications. Below is a comprehensive list of HS codes for various dental products, categorized for clarity.

| Category | HS Code | Description |

|---|---|---|

| Dental Cements & Fillings | 3006400000 | Dental cements, fillings, and other restorative materials, including adhesives and sealants. |

| Dental Chairs & Equipment | 9018491000 | Dental chair equipped with dental devices. |

| 9018410000 | Dental drilling machines, either standalone or integrated with dental chairs. | |

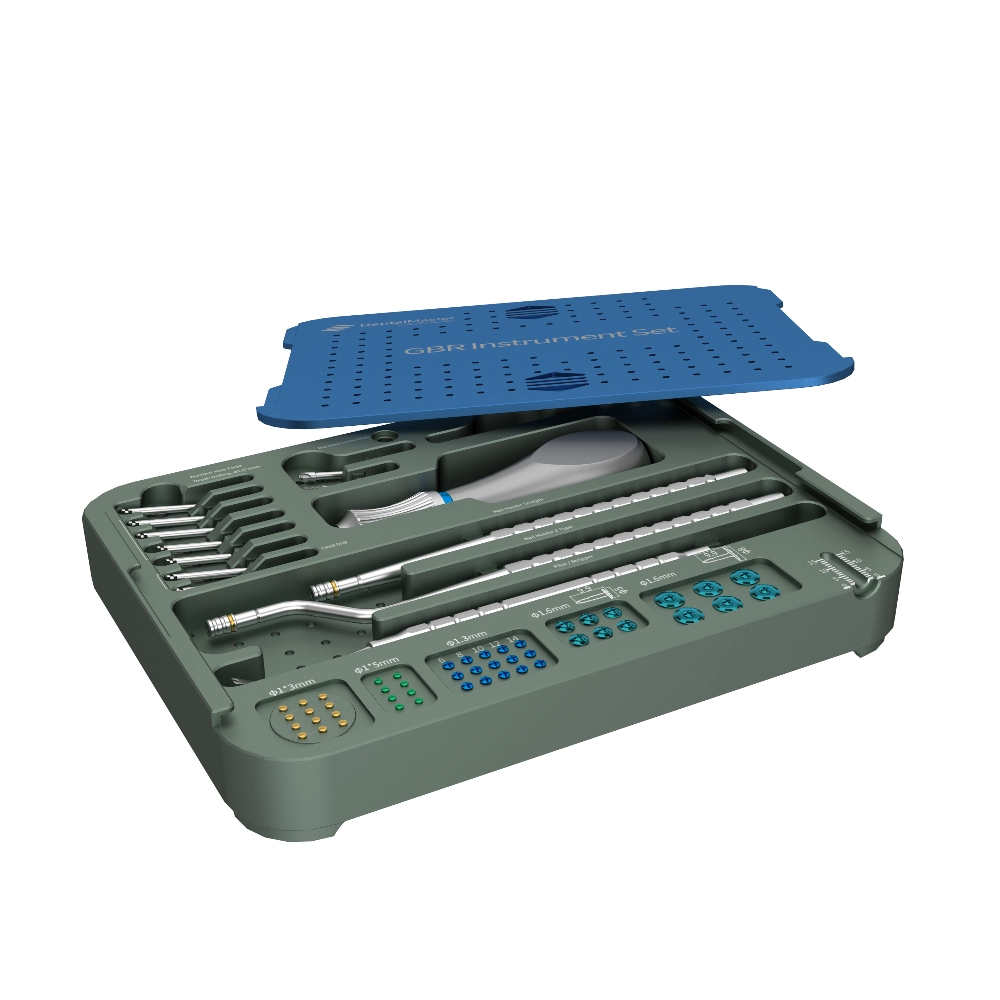

| Dental Instruments & Tools | 3005909000 | Dental instrument sets, root canal files, and other unspecified dental tools. |

| Dentures & Artificial Teeth | 9021210000 | Dental dentures, including fixed porcelain dentures and removable plastic dentures. |

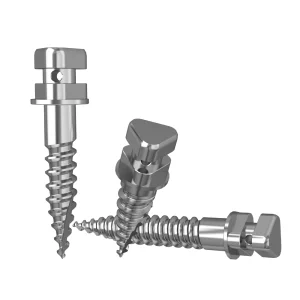

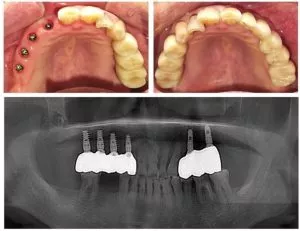

| Dental Implants & Accessories | 9021290000 | Dental implants and tooth retainers, such as titanium implants and abutments (verify the latest codes). |

| Dental Molding & Impression Materials | 3407001000 | Dental wax for modeling and carving. |

| 3407002000 | Dental impression pastes and other modeling materials. | |

| Dental Porcelain Powder & Molds | 8474809090 | Dental porcelain powder and molds for denture manufacturing. |

| 9023009000 | Dental teaching models and treatment planning models. | |

| Dental Imaging Equipment | 9022130000 | Dental X-ray machines, including digital imaging devices. |

| 8545200000 | Non-medical dental imaging devices. |

Important Considerations for Dental Product Imports/Exports

- Regulations and Compliance:

- Ensure compliance with international health and safety standards (e.g., FDA, CE certifications).

- Verify product-specific regulatory requirements for different countries.

- Code Accuracy:

- HS codes are subject to periodic updates. Always refer to the latest customs database or consult a licensed customs broker.

- Tax and Tariff Rates:

- Import duties and VAT rates may vary significantly based on the country of import. Check local tax regulations for precise calculations.

- Documentation Requirements:

- Properly labeled product specifications and certifications are crucial for smooth customs clearance.

Application of HS Codes in the Import and Export of Dental Products

Declaration Process

In the import and export of dental products, the declaration of HS codes is a critical step. The detailed declaration process includes:

- Preparation of Relevant Documents:

Prepare essential import and export documents such as invoices, packing lists, contracts, bills of lading, or air waybills. Depending on the product’s characteristics and the destination country’s regulations, additional documents like product manuals, inspection reports, and certificates of conformity may also be required. - Determination of HS Codes:

Based on the specific type, material, and use of the dental product, accurately determine its HS code by consulting customs databases or professional customs agents. This step is crucial for ensuring accurate declarations and preventing future issues. - Filling Out the Declaration Form:

On the import or export declaration form, fill in the product name, quantity, value, country of origin, and the determined HS code. Other relevant information, such as consignee and consignor details and transportation methods, should also be provided. - Submission for Customs Review:

Submit the completed declaration form and supporting documents to customs for review. Customs will verify the information against the HS code database to ensure accuracy and compliance. - Payment of Taxes and Duties:

Based on the customs review, taxes and duties will be calculated according to the HS code’s applicable rates. Payments may include customs duties, value-added tax (VAT), and excise tax. - Customs Clearance:

Once taxes and duties are paid, customs may inspect the dental products before granting clearance. If the products meet all requirements and regulations, customs will officially release them for import or export.

Tax Calculation

The calculation of taxes and duties for importing and exporting dental products primarily involves customs duties, VAT, and excise taxes:

- Customs Duty:

Calculated based on the HS code’s tax rate.

Formula: Customs Duty = Customs Value × Customs Duty Rate.

Customs Value: Transaction price plus relevant costs (e.g., freight, insurance). - Value-Added Tax (VAT):

VAT applies to the value added during the import/export process.

Formula: VAT = (Customs Value + Customs Duty) × VAT Rate. - Excise Tax:

Certain premium dental products (e.g., luxury dentures) may also incur excise taxes, calculated similarly to VAT but with varying rates and bases.

Regulatory Requirements

Countries impose strict regulatory requirements on the import and export of dental products to ensure product safety, compliance, and quality. Common requirements include:

- Licenses:

Some countries require import/export licenses, which may involve rigorous approval processes. - Certifications:

Products may need certifications such as ISO or CE to ensure safety and quality, often requiring performance, safety, and environmental evaluations. - Inspections:

Customs may inspect products to verify compliance with regulations, focusing on appearance, quality, and functionality.

Role of HS Codes in Regulatory Compliance:

HS codes play a vital role in regulatory processes. They serve as the basis for customs classification, tax calculation, and inspection. By referencing the HS code, customs authorities can quickly identify a product’s nature, purpose, and classification, enabling appropriate regulatory actions.

In summary, the application of HS codes in dental product imports and exports involves declaration procedures, tax calculations, and regulatory compliance. Accurate use of HS codes is essential for the smooth clearance of dental products in international trade.